Business Name: BeeHive Homes Assisted Living

Address: 16220 West Rd, Houston, TX 77095

Phone: (832) 906-6460

BeeHive Homes Assisted Living

BeeHive Homes Assisted Living of Cypress offers assisted living and memory care services in a warm, comfortable, and residential setting. Our care philosophy focuses on personalized support, safety, dignity, and building meaningful connections for each resident. Welcoming new residents from the Cypress and surrounding Houston TX community.

16220 West Rd, Houston, TX 77095

Business Hours

Monday thru Sunday: 7:00am - 7:00pm

Facebook: https://www.facebook.com/BeeHiveHomesCypress

Families seldom spending plan for the day a parent requires help with bathing or begins to forget the range. It feels unexpected, even when the signs were there for years. I have sat at kitchen tables with boys who handle spreadsheets for a living and children who kept every receipt in a shoebox, all gazing at the same concern: how do we pay for assisted living or memory care without dismantling everything our parents built? The answer is part math, part values, and part timing. It requires honest conversations, a clear inventory of resources, and the discipline to compare care models with both heart and calculator in hand.

What care in fact costs - and why it varies so much

When people say "assisted living," they typically visualize a tidy apartment or condo, a dining-room with choices, and a nurse down the hall. What they don't see is the pricing complexity. Base rates and care fees operate like airline tickets: similar seats, very various rates depending on demand, services, and timing.

Across the United States, assisted living base rents typically range from 3,000 to 6,000 dollars monthly. That base rate generally covers a private or semi-private home, energies, meals, activities, and light housekeeping. The fork in the road is the care plan. Help with medications, bathing, dressing, and movement typically adds tiered fees. For someone needing one to 2 "activities of daily living" (ADLs), add 500 to 1,500 dollars. For more substantial support, the care part can climb to 2,500 dollars or more. Falls, diabetes management, incontinence, and night-time wandering tend to increase costs due to the fact that they need more staffing and scientific oversight.

Memory care is almost always more expensive, because the environment is secured and staffed for cognitive disability. Normal all-in costs run 5,500 to 9,000 dollars each month, in some cases higher in major city locations. The greater rate reflects smaller sized staff-to-resident ratios, specialized programming, and security innovation. A resident who wanders, sundowns, or resists care needs predictable staffing, not just kind intentions.

Respite care lands somewhere in between. Communities typically use furnished homes for brief stays, priced per day or weekly. Expect 150 to 350 dollars each day for assisted living respite, and 200 to 400 dollars per day for memory care respite, depending on area and level of care. This can be a wise bridge when a household caregiver needs a break, a home is being refurbished to accommodate safety modifications, or you are checking fit before a longer commitment.

Costs vary for real reasons. A suburban community near a major hospital and with tenured personnel will be pricier than a rural option with higher turnover. A more recent building with personal balconies and a restaurant charges more than a modest, older home with shared rooms. None of this necessarily anticipates quality of care, but it does affect the monthly expense. Touring 3 places within the very same postal code can still produce a 1,500 dollar spread.

Start with the real concern: what does your parent need now, and what will likely change

Before crunching numbers, assess care requirements with uniqueness. 2 cases that look similar on paper can diverge quickly in practice. A father with mild memory loss who is calm and social might do very well in assisted living with medication management and cueing. A mother with vascular dementia who becomes anxious at sunset and tries to leave the building after dinner will be much safer in memory care, even if she appears physically stronger.

A medical care doctor or geriatrician can complete a functional assessment. The majority of communities will also do their own examination before approval. Ask to memory care map current requirements and probable progression over the next 12 to 24 months. Parkinson's disease and lots of dementias follow familiar arcs. If a relocate to memory care promises within a year or two, put numbers to that now. The worst financial surprises come when households budget plan for the least pricey situation and after that higher care needs arrive with urgency.

I dealt with a family who discovered a charming assisted living choice at 4,200 dollars a month, with an approximated care plan of 800 dollars. Within nine months, the resident's diabetes destabilized, leading to more frequent tracking and a higher-tier insulin management program. The care plan jumped to 1,900 dollars. The overall still made sense, however since the adult children expected a flatter cost curve, it shook their spending plan. Good preparation isn't about anticipating the impossible. It has to do with acknowledging the range.

Build a tidy monetary photo before you tour anything

When I ask households for a financial picture, many reach for the most recent bank statement. That is just one piece. Develop a clear, current view and write it down so everyone sees the very same numbers.

- Monthly income: Social Security, pensions, annuities, required minimum distributions, and any rental earnings. Note net quantities, not gross. Liquid properties: checking, savings, cash market funds, brokerage accounts, CDs, money value of life insurance coverage. Determine which assets can be tapped without charges and in what order. Non-liquid assets: the home, a getaway residential or commercial property, a small business interest, and any possession that might require time to offer or lease. Benefits and policies: long-lasting care insurance coverage (advantage triggers, daily maximum, removal duration, policy cap), VA advantages eligibility, and any employer senior citizen benefits. Liabilities: home mortgage, home equity loans, credit cards, medical financial obligation. Comprehending obligations matters when choosing between leasing, selling, or obtaining versus the home.

This is list one of two. Keep it brief and accurate. If one sibling handles Mom's money and another doesn't know the accounts, start here to eliminate secret and resentment.

With the picture in hand, create a simple monthly capital. If Mom's income amounts to 3,200 dollars per month and her likely assisted living cost is 5,500 dollars, you can see a 2,300 dollar month-to-month gap. Multiply by 12 to get the annual draw, then consider how long existing assets can sustain that draw presuming modest portfolio development. Lots of households use a conservative 3 to 4 percent net return for planning, although real returns will vary.

Understand what Medicare and Medicaid cover, and what they do n'thtmlplcehlder 44end. A harsh surprise for lots of: Medicare does not pay for assisted living or memory care space and board. Medicare covers medical services, not custodial care. It will pay for hospitalizations, physician gos to, specific treatments, and limited home health under strict requirements. It may cover hospice services offered within a senior living community. It will not pay the month-to-month rent. Medicaid, by contrast, can cover some long-term care expenses for those who satisfy medical and financial eligibility. Medicaid is state-administered, and coverage rules vary commonly. Some states provide Medicaid waivers for assisted living or memory care, typically with waitlists and limited supplier networks. Others designate more financing to nursing homes. If you think Medicaid may become part of the strategy, speak early with an elder law lawyer who knows your state's guidelines on possession limits, earnings caps, and look-back durations for transfers. Planning ahead can maintain choices. Waiting until funds are depleted can limit options to neighborhoods with offered Medicaid beds, which might not be where you want your parent to live. The Veterans Administration is another possible resource. The Help and Participation pension can supplement earnings for eligible veterans and surviving spouses who need aid with day-to-day activities. Benefit quantities vary based on reliance, earnings, and properties, and the application requires extensive documents. I have seen families leave thousands on the table because no one knew to pursue it. Long-term care insurance coverage: read the policy, not the brochure

If your parent owns long-term care insurance coverage, the policy information matter more than the premium history. Every policy has triggers, limitations, and exclusions.

Most policies need that a licensed expert accredit the insured needs aid with two or more ADLs or requires guidance due to cognitive disability. The elimination period functions like a deductible measured in days, often 30 to 90. Some policies count calendar days after advantage triggers are fulfilled, others count just days when paid care is supplied. If your elimination duration is based upon service days and you only get care three days a week, the clock moves slowly.

Daily or month-to-month optimums cap how much the insurance company pays. If the policy pays up to 200 dollars each day and the neighborhood costs 240 each day, you are responsible for the difference. Lifetime maximums or swimming pools of money set the ceiling. Inflation riders, if consisted of, can help policies written decades ago remain beneficial, but benefits might still lag present costs in expensive markets.

Call the insurance provider, demand a benefits summary, and ask how claims are started for assisted living or memory care. Communities with experienced business offices can help with the paperwork. Families who prepare to "save the policy for later" in some cases find that later showed up two years previously than they realized. If the policy has a minimal swimming pool, you may utilize it during the highest-cost years, which for numerous remain in memory care rather than early assisted living.

The home: offer, lease, borrow, or keep

For lots of older adults, the home is the largest property. What to do with it is both financial and emotional. There is no universal right answer.

Selling the home can fund numerous years of senior living expenses, particularly if equity is strong and the property requires pricey maintenance. Families frequently think twice because selling feels like a final step. Look out for market timing. If the house requires repair work to command a good rate, weigh the cost and time against the bring costs of waiting. I have actually seen households invest 30,000 dollars on upgrades that returned 20,000 in price due to the fact that they were remodeling to their own taste rather than to purchaser expectations.

Renting the home can produce earnings and buy time. Run a sober pro forma. Deduct property taxes, insurance, management costs, maintenance, and expected jobs from the gross lease. A 3,000 dollar regular monthly lease that nets 1,800 after costs might still be rewarding, specifically if selling activates a large capital gain or if there is a desire to keep the home in the household. Keep in mind, rental income counts in Medicaid eligibility estimations. If Medicaid is in the picture, talk with counsel.

Borrowing against the home through a home equity credit line or a reverse mortgage can bridge a shortage. A reverse home loan, when used correctly, can provide tax-free cash flow and keep the property owner in location for a time, and in many cases, fund assisted living after leaving if the spouse stays in the home. However the charges are genuine, and when the customer completely leaves the home, the loan ends up being due. Reverse home loans can be a clever tool for particular circumstances, specifically for couples when one partner stays home and the other moves into care. They are not a cure-all.

Keeping the home in the family often works best when a kid plans to reside in it and can purchase out brother or sisters at a fair rate, or when there is a strong sentimental reason and the carrying costs are workable. If you choose to keep it, treat your house like a financial investment, not a shrine. Budget plan for roof, HVAC, and aging facilities, not simply lawn care.

Taxes matter more than people expect

Two households can invest the exact same on senior living and end up with very different after-tax outcomes. A couple of points to view:

- Medical expense deductions: A substantial portion of assisted living or memory care costs might be tax deductible if the resident is considered chronically ill and care is supplied under a strategy of care by a licensed specialist. Memory care costs often certify at a higher percentage due to the fact that guidance for cognitive problems is part of the medical requirement. Seek advice from a tax professional. Keep comprehensive invoices that separate lease from care. Capital gains: Offering valued investments or a 2nd home to fund care sets off gains. Timing matters. Spreading out sales over calendar years, gathering losses, or coordinating with required minimum distributions can soften the tax hit. Basis step-up: If one spouse passes away while owning valued assets, the surviving spouse might get a step-up in basis. That can change whether you offer the home now or later on. This is where an elder law lawyer and a CPA earn their keep. State taxes: Relocating to a neighborhood throughout state lines can change tax direct exposure. Some states tax Social Security, others do not. Integrate this with proximity to family and healthcare when selecting a location.

This is the unglamorous part of planning, but every dollar you avoid unneeded taxes is a dollar that pays for care or maintains alternatives later.

Compare neighborhoods the method a CFO would, with tenderness

I love a great tour. The lobby smells like cookies, and the activity calendar is impressive. Still, the financial file is as crucial as the amenities. Request the cost schedule in writing, consisting of how and when care charges alter. Some communities utilize service indicate rate care, others utilize tiers. Understand which services fall under which tier. Ask how often care levels are reassessed and just how much notification you receive before costs change.

Ask about yearly rent increases. Normal boosts fall in between 3 and 8 percent. I have seen special assessments for significant renovations. If a community belongs to a larger business, pull public reviews with an important eye. Not every unfavorable evaluation is fair, however patterns matter, specifically around billing practices and staffing consistency.

Memory care ought to come with training and staffing ratios that line up with your loved one's requirements. A resident who is a flight danger needs doors, not guarantees. Wander-guard systems avoid tragedies, but they also cost money and need attentive staff. If you anticipate to depend on respite care regularly, inquire about schedule and rates now. Many communities focus on respite during slower seasons and limit it when tenancy is high.

Finally, do a basic stress test. If the community raises rates by 5 percent next year and the year after, can your plan absorb it? If care requirements leap a tier, what occurs to your month-to-month gap? Strategies should tolerate a few undesirable surprises without collapsing.

Bringing household into the strategy without blowing it up

Money and caregiving draw out old family dynamics. Clearness assists. Share the financial photo with the person who holds the durable power of lawyer and any siblings involved in decision-making. If one relative supplies the majority of hands-on care in your home, element that into how resources are used and how decisions are made. I have actually watched relationships fray when an exhausted caregiver feels unnoticeable while out-of-town siblings press to postpone a relocation for cost reasons.

If you are considering private caretakers in your home as an alternative or a bridge, rate it honestly. Twelve hours a day at 30 dollars per hour is approximately 10,800 dollars monthly, not including employer taxes if you employ straight. Over night needs typically push families into 24-hour protection, which can easily go beyond 18,000 dollars each month. Assisted living or memory care is not automatically cheaper, but it typically is more predictable.

Use respite care strategically

Respite care is more than a breather. It can be a monetary reconnaissance objective. A two-week respite stay lets you observe staffing, food, responsiveness, and culture without a year-long dedication. It likewise provides the community a chance to know your parent. If the team sees that your father grows in activities or your mother needs more hints than you realized, you will get a clearer photo of the real care level. Numerous neighborhoods will credit some part of respite fees towards the community fee if you select to move in, which softens duplication.

Families in some cases utilize respite to line up the timing of a home sale, to produce breathing space throughout post-hospital rehabilitation, or to check memory care for a partner who insists they "don't need it." These are smart usages of short stays. Utilized moderately but tactically, respite care can prevent rushed decisions and prevent costly missteps.

Sequence matters: the order in which you use resources can protect options

Think like a chess player. The first move affects the fifth.

- Unlock benefits early: If long-lasting care insurance coverage exists, initiate the claim when sets off are met rather than waiting. The removal duration clock won't start up until you do, and you don't recapture that time by delaying. Right-size the home choice: If selling the home is most likely, prepare documentation, clear clutter, and line up a representative before funds run thin. Much better to offer with a 90-day runway than under pressure. Coordinate withdrawals: Use taxable represent near-term needs when possible, while handling capital gains, then tap tax-deferred accounts as required minimum circulations start. Line up with the tax year. Use family aid deliberately: If adult children are contributing funds, formalize it. Choose whether cash is a gift or a loan, record it, and comprehend Medicaid implications if the parent later on applies. Build reserves: Keep three to 6 months of care expenditures in cash equivalents so short-term market swings don't require you to sell financial investments at a loss to satisfy monthly bills.

This is list two of 2. It shows patterns I have actually seen work consistently, not rules carved in stone.

Avoid the costly mistakes

A few mistakes appear over and over, often with huge rate tags.

Families often place a parent based entirely on a lovely home without observing that the care team turns over constantly. High turnover frequently implies irregular care and regular re-assessments that ratchet fees. Do not be shy about asking for how long the administrator, nursing director, and memory care supervisor have remained in place.

Another trap is the "we can handle in your home for just a bit longer" technique without recalculating expenses. If a main caregiver collapses under the pressure, you may face a hospital stay, then a rapid discharge, then an immediate positioning at a community with immediate schedule rather than finest fit. Planned transitions normally cost less and feel less chaotic.

Families likewise ignore how quickly dementia advances after a medical crisis. A urinary system infection can cause delirium and an action down in function from which the person never fully rebounds. Budgeting needs to acknowledge that the gentle slope can in some cases develop into a steeper hill.

Finally, beware of financial items you don't totally comprehend. I am not anti-annuity or anti-reverse home mortgage. Both can be appropriate. But funding senior living is not the time for high-commission complexity unless it plainly fixes a specified issue and you have compared alternatives.

When the money may not last

Sometimes the math states the funds will go out. That does not suggest your parent is predestined for a poor outcome, however it does mean you must plan for that minute instead of hope it never ever arrives.

Ask communities, before move-in, whether they accept Medicaid after a personal pay period, and if so, the length of time that duration needs to be. Some need 18 to 24 months of personal pay before they will think about converting. Get this in composing. Others do decline Medicaid at all. Because case, you will require to prepare for a relocation or ensure that alternative financing will be available.

If Medicaid becomes part of the long-lasting strategy, ensure possessions are titled correctly, powers of lawyer are present, and records are pristine. Keep invoices and bank statements. Unexplained transfers raise flags. A great elder law lawyer makes their fee here by minimizing friction later.

Community-based Medicaid services, if readily available in your state, can be a bridge to keep somebody in your home longer with at home aid. That can be a humane and cost-effective route when proper, specifically for those not yet ready for the structure of memory care.

Small choices that produce flexibility

People obsess over big choices like selling the house and gloss over the small ones that compound. Going with a slightly smaller sized apartment or condo can shave 300 to 600 dollars per month without harming quality of care. Bringing individual furniture instead of buying brand-new can maintain money. Cancel memberships and insurance policies that no longer fit. If your parent no longer drives, remove cars and truck costs instead of leaving the lorry to depreciate and leak money.

Negotiate where it makes good sense. Communities are most likely to change neighborhood fees or use a month complimentary at fiscal year-end or when occupancy dips. If you are moving a couple into assisted living with one spouse in memory care, inquire about bundled rates. It will not constantly work, but it in some cases does.

Re-visit the plan two times a year. Needs shift, markets move, policies upgrade, and household capability changes. A thirty-minute check-in can capture a developing issue before it becomes a crisis.

The human side of the ledger

Planning for senior living is financing twisted around love. Numbers give you options, but values tell you which choice to pick. Some parents will invest down to make sure the calmer, much safer environment of memory care. Others wish to maintain a tradition for kids, accepting more modest environments. There is no incorrect answer if the individual at the center is appreciated and safe.

A child as soon as told me, "I thought putting Mom in memory care suggested I had failed her." 6 months later, she said, "I got my relationship with her back." The line product that made that possible was not just the lease. It was the relief that enabled her to visit as a child rather than as a tired caretaker. That is not a number you can plug into a spreadsheet, yet it belongs in the calculation.

Good preparation turns a frightening unidentified into a series of manageable actions. Know what care levels cost and why. Stock earnings, assets, and advantages with clear eyes. Check out the long-lasting care policy carefully. Decide how to deal with the home with both heart and math. Bring taxes into the conversation early. Ask hard questions on trips, and pressure-test your plan for the likely bumps. If resources might run short, prepare pathways that keep dignity.

Assisted living, memory care, and respite care are not simply lines in a spending plan. They are tools to keep an older adult safe, engaged, and appreciated. With a working plan, you can focus less on the invoice and more on the individual you like. That is the genuine roi in senior care.

BeeHive Homes Assisted Living is an Assisted Living Facility

BeeHive Homes Assisted Living is an Assisted Living Home

BeeHive Homes Assisted Living is located in Cypress, Texas

BeeHive Homes Assisted Living is located Northwest Houston, Texas

BeeHive Homes Assisted Living offers Memory Care Services

BeeHive Homes Assisted Living offers Respite Care (short-term stays)

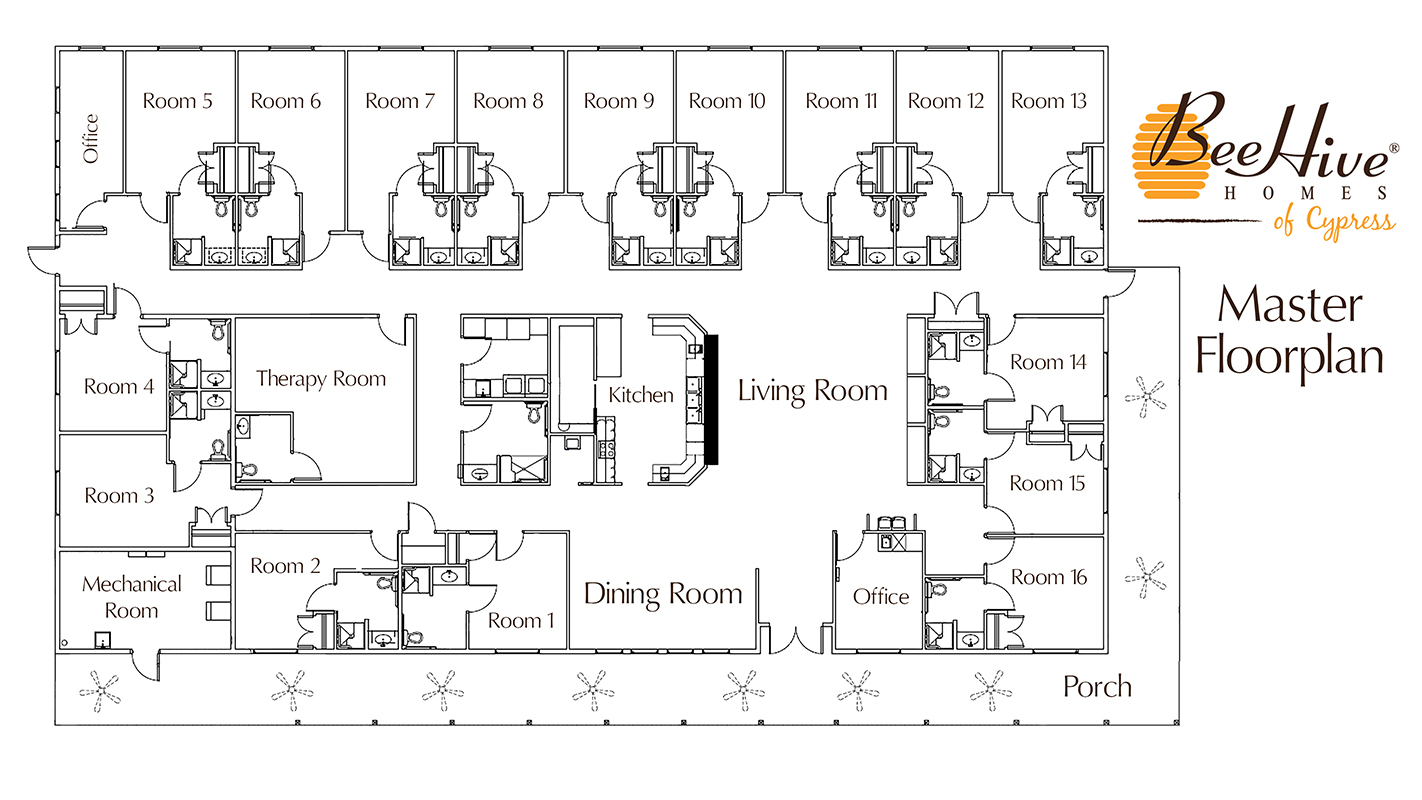

BeeHive Homes Assisted Living provides Private Bedrooms with Private Bathrooms for their senior residents

BeeHive Homes Assisted Living provides 24-Hour Staffing

BeeHive Homes Assisted Living serves Seniors needing Assistance with Activities of Daily Living

BeeHive Homes Assisted Living includes Home-Cooked Meals Dietitian-Approved

BeeHive Homes Assisted Living includes Daily Housekeeping & Laundry Services

BeeHive Homes Assisted Living features Private Garden and Green House

BeeHive Homes Assisted Living has a Hair/Nail Salon on-site

BeeHive Homes Assisted Living has a phone number of (832) 906-6460

BeeHive Homes Assisted Living has an address of 16220 West Road, Houston, TX 77095

BeeHive Homes Assisted Living has website https://beehivehomes.com/locations/cypress

BeeHive Homes Assisted Living has Google Maps listing https://maps.app.goo.gl/G6LUPpVYiH79GEtf8

BeeHive Homes Assisted Living has Facebook page https://www.facebook.com/BeeHiveHomesCypress

BeeHive Homes Assisted Living is part of the brand BeeHive Homes

BeeHive Homes Assisted Living focuses on Smaller, Home-Style Senior Residential Setting

BeeHive Homes Assisted Living has care philosophy of “The Next Best Place to Home”

BeeHive Homes Assisted Living has floorplan of 16 Private Bedrooms with ADA-Compliant Bathrooms

BeeHive Homes Assisted Living welcomes Families for Tours & Consultations

BeeHive Homes Assisted Living promotes Engaging Activities for Senior Residents

BeeHive Homes Assisted Living emphasizes Personalized Care Plans for each Resident

BeeHive Homes Assisted Living won Top Branded Assisted Living Houston 2025

BeeHive Homes Assisted Living earned Outstanding Customer Service Award 2024

BeeHive Homes Assisted Living won Excellence in Assisted Living Homes 2023

People Also Ask about BeeHive Homes Assisted Living

What services does BeeHive Homes Assisted Living of Cypress provide?

BeeHive Homes Assisted Living of Cypress provides a full range of assisted living and memory care services tailored to the needs of seniors. Residents receive help with daily activities such as bathing, dressing, grooming, medication management, and mobility support. The community also offers home-cooked meals, housekeeping, laundry services, and engaging daily activities designed to promote social interaction and cognitive stimulation. For individuals needing specialized support, the secure memory care environment provides additional safety and supervision.

How is BeeHive Homes Assisted Living of Cypress different from larger assisted living facilities?

BeeHive Homes Assisted Living of Cypress stands out for its small-home model, offering a more intimate and personalized environment compared to larger assisted living facilities. With 16 residents, caregivers develop deeper relationships with each individual, leading to personalized attention and higher consistency of care. This residential setting feels more like a real home than a large institution, creating a warm, comfortable atmosphere that helps seniors feel safe, connected, and truly cared for.

Does BeeHive Homes Assisted Living of Cypress offer private rooms?

Yes, BeeHive Homes Assisted Living of Cypress offers private bedrooms with private or ADA-accessible bathrooms for every resident. These rooms allow individuals to maintain dignity, independence, and personal comfort while still having 24-hour access to caregiver support. Private rooms help create a calmer environment, reduce stress for residents with memory challenges, and allow families to personalize the space with familiar belongings to create a “home-within-a-home” feeling.

Where is BeeHive Homes Assisted Living located?

BeeHive Homes Assisted Living is conveniently located at 16220 West Road, Houston, TX 77095. You can easily find direction on Google Maps or visit their home during business hours, Monday through Sunday from 7am to 7pm.

How can I contact BeeHive Homes Assisted Living?

You can contact BeeHive Assisted Living by phone at: 832-906-6460, visit their website at https://beehivehomes.com/locations/cypress/, or connect on social media via Facebook

BeeHive Assisted Living is proud to be located in the greater Northwest Houston area, serving seniors in Cypress and all surrounding communities, including those living in Aberdeen Green, Copperfield Place, Copper Village, Copper Grove, Northglen, Satsuma, Mill Ridge North and other communities of Northwest Houston.